Adding Insult to Injury: Taxes During Divorce

Every mediation session has a discussion regarding taxes.

Every mediation session has a discussion regarding taxes.

Before you delve into the details below, I want to highlight some important concepts that my clients find valuable. This is for clients who file taxes individually after a divorce and refers only to filing your federal IRS tax return. For specific details that may change year-to-year such as deduction amounts, please review the IRS filing instructions for the tax year you are concerned about.

- You are married or not married for the option of filing taxes jointly on December 31 of every year. There is no proration. You have the option to file “Married Filing Separately” if you are married. If you are divorced before December 31st of any year then each of you must file an independent return with either single or head of household status.

- The parent who is qualified to be Head of Household (HOH) will have a standard deduction from income, regardless of whether you have one child or 5 children. There are no deductions per dependent. The other parent who is not HOH will also have a standard deduction.

- If there is a 50:50 parenting plan and two or more children, both parents may qualify to be HOH. Each parent would claim 1 or more children each.

- For children under age 17, there may be a child tax credit. This credit goes to the parent that provided over half of the support during the year and whom the child lived for at least half the year.

- When you file taxes individually, it is very important to look at your weekly or monthly tax deductions from your paycheck. While it once might have been OK to have a big tax refund, usually when living separately, now you may need every penny. The goal is to break even with taxes. To make this happen, either work with your accountant or use the IRS Tax Withholding Estimator (video tutorial is available). Once you have an idea of the total amount of tax you will owe, contact your payroll department to set up the tax deduction from your wages.

The rest of the blog below this section explains the IRS terminology and the technical details regarding claiming Head of Household and dependents. These are two of the most important aspects of tax treatment.

As always, please do not act on the information in this blog without first seeking professional counsel and checking IRS resources for current tax requirements.

How to File Income Taxes During Divorce

One aspect of life’s complexity is income taxes. To make matters worse, tax complexity increases during and after divorce. Therefore, you must arm yourself with knowledge and know when you need additional help. Because of that complexity, this discussion is limited to only federal income tax issues and does not cover state income taxes.

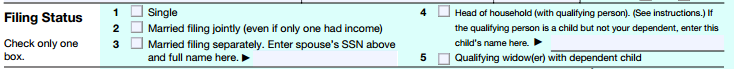

Filing Status

Let’s start at the beginning of a tax return and dive into filing status. The following image comes from the IRS 1040 Form, 2015 Version. Please refer to the correct 1040 version for the tax year you are considering.

The Internal Revenue Service (IRS) has a great tool to determine your federal tax filing status.

Income Tax Filing Status Options

Single

- Not married during the year.

- Have obtained a divorce, separate maintenance agreement (legally separated), or annulment by the last day of the year (12/31).

Married Filing Jointly

You are legally married on the last day of the year (12/31).

In most cases (but not all), filing a joint federal tax return will save on income taxes. There are some credits and deductions that are not available with the married filing separate (see below) filing status such as American opportunity credit, lifetime learning credit, tuition and fees deduction, student loan interest deduction, and the earned income credit.

If there is an error on jointly filed returns, both spouses are equally liable for the tax due. If you think your spouse is not reporting all of his income on his income tax return or is claiming bogus deductions, you may want to consider filing a married filing separate return.

Married Filing Separately

You are legally married on the last day of the year (12/31).

One advantage of married filing separately is that you do not need to communicate as much with your spouse. This is especially helpful if the divorce is charged with emotions. You do need your spouse’s name and Social Security number. You also need to determine if they are itemizing deductions.

If one spouse itemizes deductions, both must itemize (even if the result is $0).

NOTE: If you provide over half of the support for a child, then you may be able to use the head of household status (see below).

House of Household

- You are single at the end of the year (see “Single” filing status above) or are considered unmarried.

- You are considered unmarried if:

- You file a separate return (not a joint return).

- You paid more than ½ the cost of keeping up your home for the tax year.

- Your spouse didn’t live in your home during the last 6 months of the year.

- Your home was the main home of your child, stepchild, or foster child for more than ½ the year.

- You must be able to claim an exemption for the child. (There are some exceptions to this rule).

- You are considered unmarried if:

- You paid more than ½ the cost of keeping up a home for the year.

- A qualifying person lived with you in the home for more than half the year (There are some exceptions to this rule).

- Note that if there are 2 children, both parents can claim the head of household status as long as the above qualifications are met.

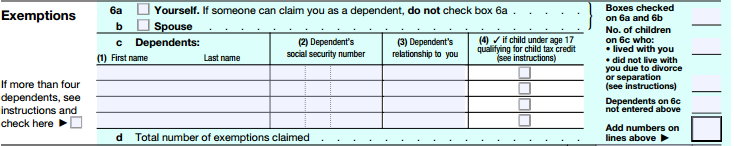

Exemptions

Once you have figured out your filing status, then you need to determine your exemptions. The following information comes from 2015 IRS Publication 17. Please refer to the relevant IRS Publication 17 for the tax year you are considering.

Personal Exemptions

- You can claim an exemption for yourself.

- You can claim an exemption for your spouse if you file a joint return (see “Married Filing Jointly” above).

- If you file a married filing separate return, you can claim an exemption for your spouse if the spouse had no gross income, isn’t filing a return, and wasn’t a dependent of another taxpayer.

- If you obtain a divorce or separation agreement, then you are not able to claim your spouse’s exemption (even if you provided all their support).

Dependency Exemptions

There are 2 types of dependents:

- Qualifying child

- Qualifying relative

The focus of this discussion in on the qualifying child.

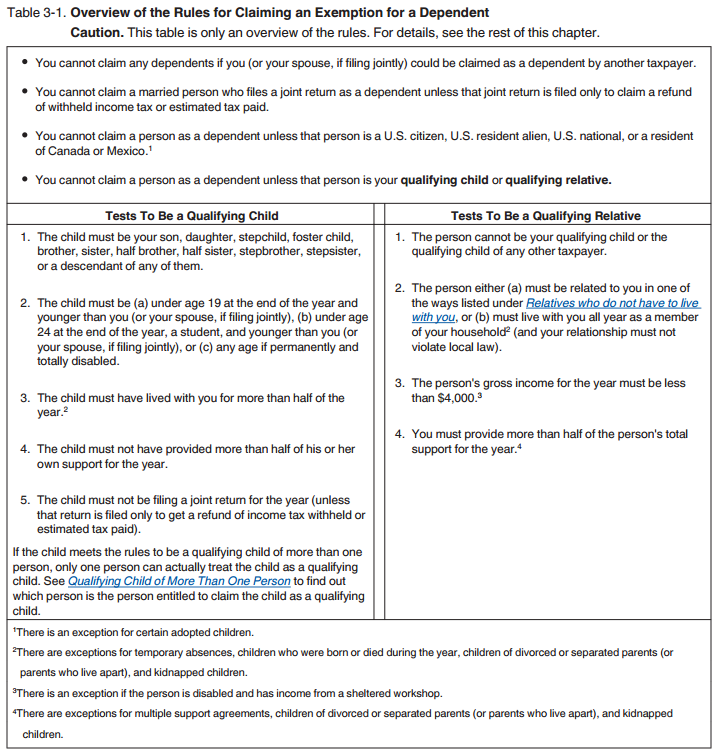

There are 5 tests that must be met in order to claim a qualifying child as dependent:

1. Qualifying Child Relationship Test

See above chart.

2. Qualifying Child Age Test

See above chart.

3. Qualifying Child Residency Test

The child must have lived with you for more than half the year. Temporary absences for school count as living with you.

For children of divorced parents, typically the custodial parent will claim the dependency exemption.

However, there is an exception. The child will be treated as the qualifying child of the noncustodial parent if all four of the following statements are true:

- The parents:

a. Are divorced or legally separated under a decree of divorce or separate maintenance, or

b. Are separated under a written separation agreement, or

c. Lived apart at all times during the last 6 months of the year, whether or not they are or were married. - The child received over half of his or her support for the year from the parents.

- The child is in the custody of one or both parents for more than half of the year.

- Either of the following statements is true:

a. The custodial parent signs a written declaration that he or she won’t claim the child as a dependent for the year, and the noncustodial parent attaches this written declaration to his or her return, or

b. There is a pre-1985 decree of divorce or separate maintenance or written separation agreement that applies to 2015 and:- States that the noncustodial parent can claim the child as a dependent, and

- The decree or agreement wasn’t changed after 1984 to say the noncustodial parent cannot claim the child as a dependent, and

- The noncustodial parent provides a minimum amount (see IRS Publication 17 for the amount) for the child’s support during the year.

If statements (1) through (4) above are all true, only the noncustodial parent can claim the child as a dependent and claim the child as a qualifying child for the child tax credit.

However, this does not allow the noncustodial parent to claim head of household filing status, the credit for child and dependent care expenses, the exclusion for dependent care benefits, the earned income credit, or the health coverage tax credit.

Since no divorce or parenting arrangement is the same or simple, the IRS has developed tie-breaker rules to help determine who gets to claim the dependent.

- If only one of the persons is the child’s parent, the child is treated as the qualifying child of the parent.

- If the parents file a joint return together and can claim the child as a qualifying child, the child is treated as the qualifying child of the parents.

- If the parents do not file a joint return together but both parents claim the child as a qualifying child, the IRS will treat the child as the qualifying child of the parent with whom the child lived for the longer period of time during the year.

- If the child lived with each parent for the same amount of time, the IRS will treat the child as the qualifying child of the parent who had the higher adjusted gross income (AGI) for the year.

- If no parent can claim the child as a qualifying child, the child is treated as the qualifying child of the person who had the highest AGI for the year.

- If a parent can claim the child as a qualifying child but no parent actually claims the child, the child is treated as the qualifying child of the person who had the highest AGI for the year, but only if that person’s AGI is higher than the highest AGI of any of the child’s parents who can claim the child.

Important things to note:

- For the child tax credit , you must have a qualifying child (explained above) who is claimed as a dependent on your tax return. You do not have to file as head of household to claim this credit.

- For the credit for child and dependent care expenses, you must have a qualifying child under the age of 13 who is claimed as a depended on your return. If you are not considered unmarried and file a married filing separately return, you cannot take this credit.

- For the American Opportunity Tax Credit or the Lifetime Learning Credit, you must have a qualifying child who is claimed as a dependent on your return and is a student. You cannot claim this credit if you are married filing separately.

- Earned Income Tax Credit is not allowed when married filing separately.

- Lastly, you cannot deduct student loan interest on your return if you file as married filing separately.

4. Qualifying Child Support Test

See above chart.

5. Qualifying Child Joint Tax Return

See above chart.

As you can see there are many rules and exceptions to the rules that can make taxes complicated. For more information and guidance, contact your CPA (Certified Public Accountant).

About the Author: Jamie Block, CPA, CPA®. Jamie is a graduate of Cornell University and holds an MBA in Finance from the University of Rochester, Simon School of Business. Jamie is a registered member of NAPFA and treasurer of the Rochester Chapter of the Financial Planning Association. Jamie has been quoted on Investopedia and appears regularly on WROC to discuss tax issues. Wealth Design Services, Inc. is located at 132 Allen’s Creek Road, Rochester, NY 14618. For more information, please call 585-442-3230.

Photo credit: CanStockPhoto.com

This blog and its materials have been prepared by BJ Mediation Services for informational purposes only and are not intended to be, are not, and should not be regarded as, legal or financial advice. Internet subscribers and online readers should not act upon this information without seeking professional counsel.